Summary

- The holidays are around the corner — and the current economic environment has forced adjustments by both consumers and retailers.

- Here, we share insight about this holiday season concerning consumers’ shopping plans, preferences and priorities.

Not to sound too cliché but, the holidays really are “right around the corner.” And there’s no question the current economic environment has forced adjustments by both consumers and retailers. What’s different this year? How will it affect holiday spending? Which consumer segments plan to go all out this holiday season, and which segments will be reining it in?

To answer these questions, we asked consumers in our June Awareness-to-Action Study* about their holiday shopping plans, preferences and priorities. Here are some highlights from the survey.

Let’s first take a look at how this holiday season is different than recent ones.

Inflation levels you can’t ignore

We must mention the elephant in the room: inflation. Record inflation continues to weigh heavily on retailers, consumers and the U.S. economy. Consumers are seeing evidence of inflation every time they make or plan to make a purchase. According to the Numerator 2022 Holiday Preview Survey, nearly 90% of consumers surveyed expect inflation to affect their 2022 holiday shopping and spending. And a majority (59%) expect the impact will be moderate or significant.

Supply chain challenges

Supply chain challenges persist, although they have improved since last year. It seems consumers are now becoming conditioned to the idea that their favorite brand or product may not be available and so may be preparing to identify a plan B to use if they can’t find the specific product they need.

Gas prices affecting travel

After months of high gas prices, consumers are finally feeling some relief — but prices are still much higher than they were just one year ago. This affects everything from holiday travel plans to holiday shopping trips to the store.

Uncertainty about COVID variants

The holiday season has a lot to do with gathering with friends and family. Presumably, consumers are learning how to live with and manage the reality of variants, waves and outbreaks of the COVID virus as a way of life. For some that means holiday celebrations may be a last-minute decision — either way.

What does all this mean for consumers and their shopping behavior? We asked them, and here’s what we learned:

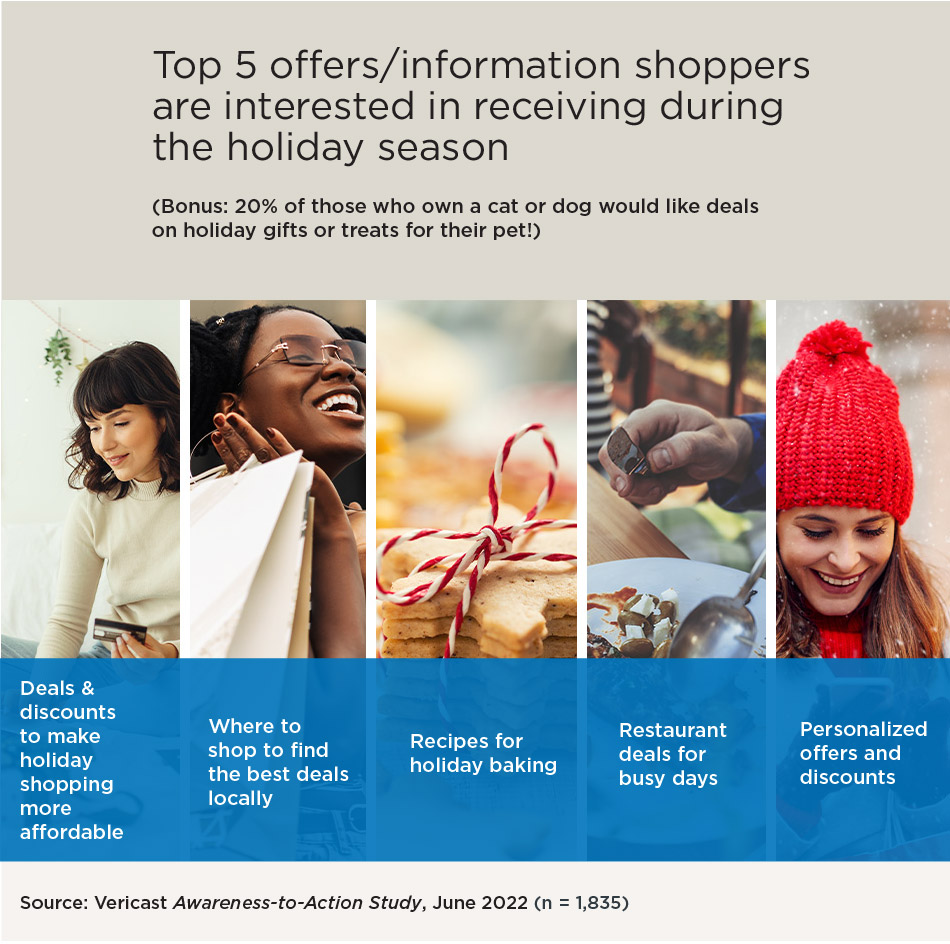

They’re looking for deals

With a cloudy economic outlook hanging over their heads, consumers are focused on stretching their dollar further. They’re more attentive to prices — our 2022 CPG + Grocery TrendWatch** notes that 61% of those surveyed say rising prices are their biggest shopping challenge — and they’re in search of a bargain. And according to our June Awareness-to-Action Study, when it comes to the shopping for gifts this year, 27% of consumers surveyed say they will look for stores that offer the best deals and sales.

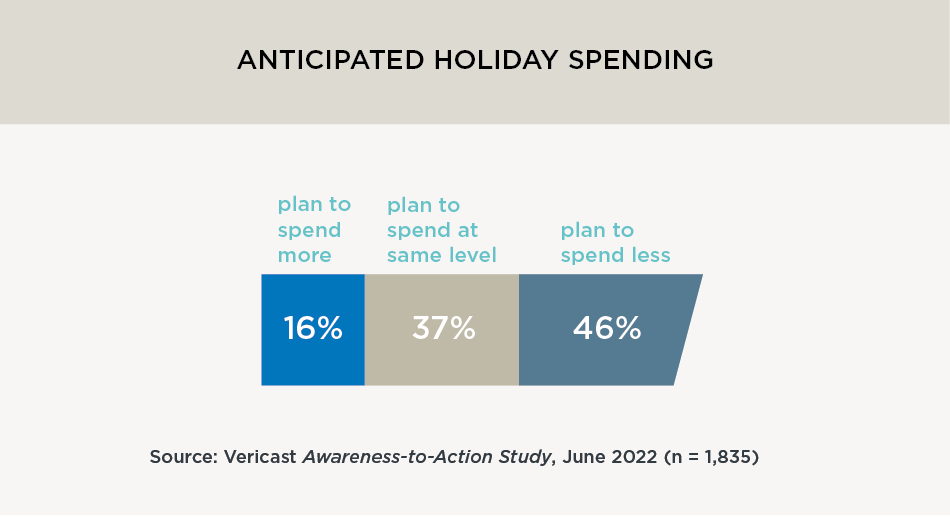

They plan to spend less

Although some consumers surveyed indicate they plan to spend more this year, including Gen Z (32%), parents (27%) and those who are very comfortable financially (32%), it should come as no surprise that in general, people say they plan to spend less this holiday season than they spent last year (46%). This is in part reportedly due to consumers choosing to dine out less over the last few months of the year (41%), especially Gen X (47%) and those with limited financial means. But some consumers (21%), including Gen Z (37%) and those with more disposable income (35%), expect to dine out more this year than last year.

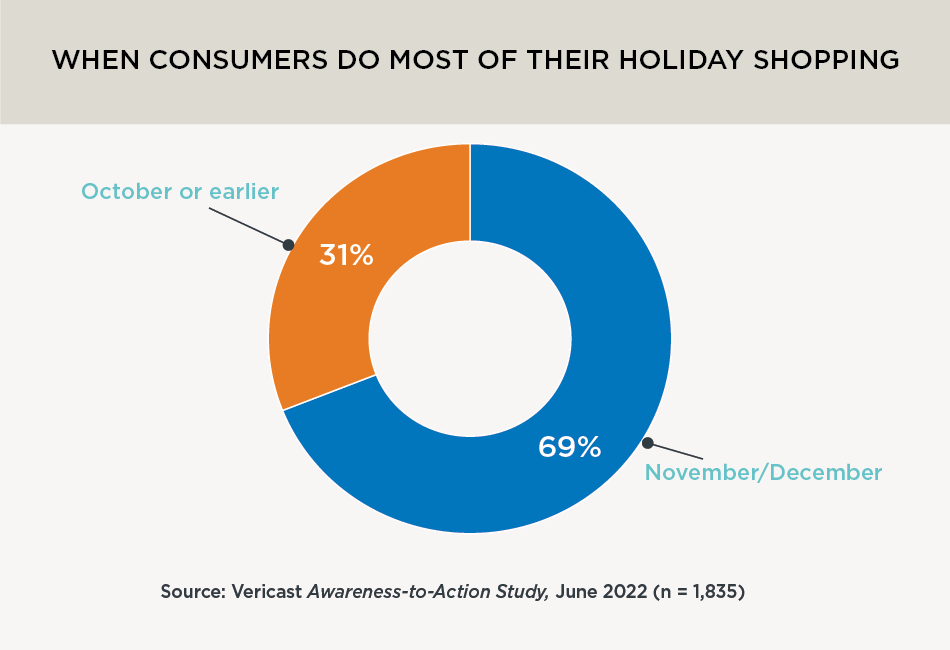

They plan to shop later in the season, some up to the last minute

Our survey data indicates people plan to delay their purchases this year. Slightly more than half of shoppers (53%) will begin their holiday shopping in November or December. Those who have a lot of savings and disposable income are more likely to get an earlier start to their shopping, prior to October (29%), while those experiencing financial challenges appear more likely to be last-minute shoppers, waiting until December to start making purchases (29%).

They plan to shop in-store and online

Some shoppers may be ready to browse the aisles again, going into brick-and-mortar store locations where they can see and touch merchandise, interact with salespeople and generally feel the hustle and bustle of the holiday season. Twenty-three percent of people we surveyed plan to shop more in-person for food and beverages for holiday parties and meals, while 14% plan to do more online shopping for these items. When it comes to shopping for gifts, 32% plan to shop more online, but 22% intend to shop more in person.

In light of consumers’ holiday plans, what can brands and retailers do to meet shopper needs and maximize the busiest, most profitable quarter of the year?

- Deals, deals, deals

This one’s straightforward. Consumers are looking for brands that offer deals. In fact, 60% of respondents to our June survey say coupons and discounts are more important than ever. If you want to catch shoppers’ attention, give them what they’re looking for — offer a discount or special deal.

- Engage in continual conversation

As indicated above, some consumers will begin shopping in October or earlier, while others will wait until November or December. Retailers and brands will have to work particularly hard to connect with consumers throughout the season since shoppers might shop late in the season or early due to myriad factors. Plan to extend your marketing throughout this year’s shopping period so you capture their attention when they’re planning and purchasing.

- Use omnichannel marketing

There’s no single outlier when it comes to how consumers like to receive their deals, so a “one-size-fits-all” approach to marketing is not sufficient. Brands and retailers should cover their bases by engaging an omnichannel strategy that reaches their target customer at all the various places they may seek information about a product or brand.

- Make it easy

Consumers will be shopping in the store and online, both in equally heavy numbers. Present them with a seamless experience, making it easy to access products and discounts wherever they plan to purchase.

To learn how the 2022 holidays will affect different industries and verticals, check out our series of seasonal recommendation videos and hear from our vertical specialists about making the most of the holidays this year.

*Except where otherwise noted data from the Vericast Awareness-to-Action Study, June 2022 (n= 1,835)

**Vericast 2022 CPG + Grocery TrendWatch: consumer survey (n = 1,909), industry survey (n = 305)