Summary

- Unveiling fun-flation: a consumer trend where memorable experiences triumph over material possessions, even in a tight economy.

- Analyzing how a desire for joyful experiences influences spending habits against a backdrop of economic constraints.

- Discussing strategic adaptations for marketers in a landscape where experiences are the new currency of consumer delight.

Welcome to the era of “fun-flation,” a new economic buzzword that isn’t just a playful spin on inflation — it’s a reflection of shifting values in a tightening economy. Despite the squeeze on wallets, there’s a growing trend among consumers to prioritize experiences they truly cherish over traditional big-ticket home purchases like electronics. Let’s dive into this phenomenon and uncover what it means for both consumers and marketers.

The Psychology of Spending

In a world where every penny counts, the mindset driving our purchases has evolved. According to the Vericast Awareness-to-Action Study, while 40% of consumers overall intend to cut back on treats or splurges, a significant 47% of Gen Xers are actively looking for more occasions to treat themselves or others. This speaks to a deeper narrative where, despite economic pressures, the desire for personal gratification persists, especially in the face of great financial stress where 49% admit to the need for restraint.

The Rise of Experience-Driven Economy

There’s a profound shift toward an experience-driven economy. Take, for example, the staggering $5.4 billion generated by Beyoncé’s Renaissance Tour and Taylor Swift’s The Eras Tour which brought in $4.6 billion. These aren’t just events; they’re cultural phenomena where fans are willing to invest in the full experience, indicating a clear preference for creating lasting memories over acquiring tangible goods.

Bringing You In the Fold: Deciphering Consumer Spending

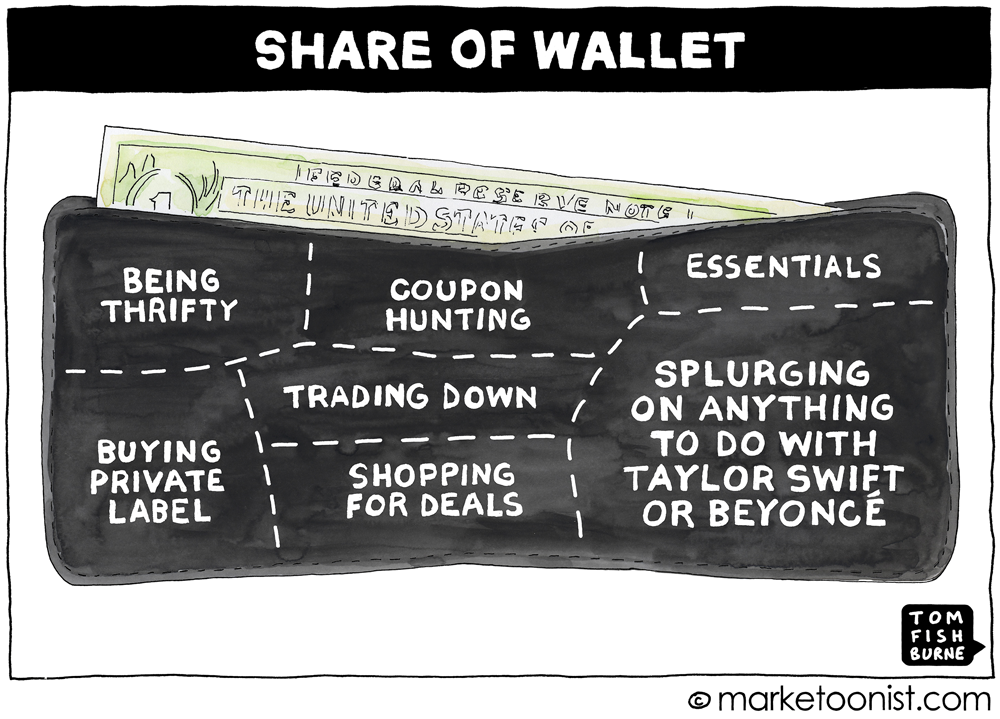

How are consumers navigating their spending habits amid this fun-flation? The ‘Share of Wallet’ concept provides a look into this dynamic. As seen below, there’s a balancing act between essential needs and the desire to splurge on experiences, even when being thrifty is top of mind.

Market Dynamics and Consumer Behavior

The market is responding to these consumer preferences, with sporting event ticket prices soaring by 25% in the face of fun-flation. Retail warnings suggest that consumers are not just passively absorbing price increases; they’re actively choosing where to allocate their funds, with a significant number opting to pay a premium for memorable experiences.

The Dichotomy of Fun-flation

The Vericast study sheds light on a fascinating dichotomy: while baby boomers (45%) and those under great financial stress (53%) lean toward spending only on essential items, there’s a contrasting trend among Gen Z (23%), parents (30%), and those with federal student loans (31%) — who are less likely to cut back. In fact, 36% of consumers are splurging on purchases or restaurant dining, with this figure jumping to 49% among affluent (HH income >$100K) consumers.

Strategic Implications for Marketers

For marketing decision-makers, understanding and adapting to fun-flation is crucial. This trend provides an opportunity to innovate how we connect with consumers, particularly those in the education and evaluation stages of the purchase journey. It’s about meeting them where they are, with messaging that resonates with their desire for experiences worth their investment.

Fun-flation is far more than a mere buzzword — it’s a testament to a resilient consumer spirit that values experiences over possessions, even when money is tight. For marketers, this shift presents an opportunity to craft strategies that tap into the desire for meaningful experiences. In the economy of fun, it’s clear that the most impactful memories are not those we buy, but those we live.

There’s more fun ahead. For consumer facts and predictions as well as seven insights shaping the marketing landscape, check out Vericast’s 2024 Marketing Outlook TrendWatch Report, Navigating the New Marketing Frontier, and see how fun-flation could redefine your next campaign.

Sources:

Vericast Awareness-to-Action Study, August 2023 (n = 1,809)

Fishburne, Tom, “share of wallet and funflation,” October 22, 2023

Harring, Alex, “‘Funflation’ drives sporting event ticket prices up a whopping 25%,” CNBC, November 21, 2023

You May Also Be Interested In

Vericast recently identified seven data-supported insights we believe will shape the marketing industry this year. Here’s a preview of what to expect.